With around 57 million residents in the nine Northeast states, representing 17% of the U.S. population, it is the region with the smallest population. It is also geographically the smallest, but has the highest share of densely populated cities, according to the U.S. Census Bureau. Overall, the Northeast accounts for around a fifth of the U.S. GDP.

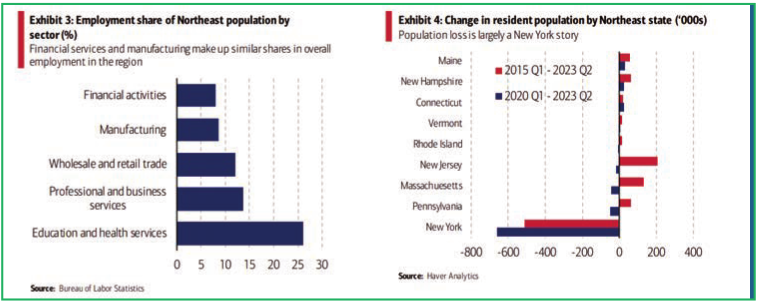

Additionally, financial activities in the Northeast account for around 8% of total employment, which compares to 6% for the U.S. as a whole, with a large share of manufacturing employment – around 8.5%, close to the U.S. average.

By far the largest drop in population in the Northeast states has occurred in New York, while most other states have seen small rises in population compared to 2015.

Total credit card spending per household in the Northeast has been growing at rates slightly above the U.S. over 2023. In the most recent data, to September 23, we see total card spending per household was up 0.4% year-over-year (YoY) in the Northeast, while overall U.S. spending was down 0.3% YoY.

U.S. Census Bureau data indicates that the Northeast has a large share of higher-income households. So, the stronger showing in spending growth in this cohort in the Northeast is likely currently a positive for overall economic momentum for the region.

But, on the other hand, previous Bank of America Consumer Checkpoints reports have noted some signs that higher-income consumers are experiencing a faster deterioration in the labor market, albeit from a base of low unemployment. Given the relatively larger share of higher income consumers in the Northeast, this relative deterioration in the labor market could represent a headwind to growth in the region if it continues.

For now, the northeastern labor market, as evidence by weekly initial jobless claims, is not performing that differently from the overall U.S.

While our per-household measures of spending show a relatively decent performance, the overall growth of the Northeast will also be impacted by whether population loss (and therefore a falling number of households) continues. The evidence is consistent with some continued loss, but at a slowing rate. In order to reduce the outflow of people, stretched housing affordability, among other areas, may need to be addressed.

Beyond the near term, an important development across the United States, including the Northeast, is growth in manufacturing capacity in semiconductors and also “clean tech” such as electric vehicles (EVs). In part, such growth has been stimulated by the CHIPS Act (Creating Helpful Incentives to Produce Semiconductors Act) and the Inflation Reduction Act. This is leading to a boom in investment in manufacturing capacity.

The good news is that the region has already reported some large investments in semiconductor fabrication plants and related supply chain investments. The announcements suggest around 10,000 people could be employed in this area by the end of this decade, with a multiple of that in subsequent decades. With the benefits of a local-supply chain including university research and development partners, these investments could offer a boost to the Northeast economy in the medium term.

To view the full report, visit business.bofa.com/en-us/content/bank-of-america-institute/economic-insights/northeast-economy-trends.html.

David Michael Tinsley is senior economist and Taylor Bowley is an economist at the Bank of America Institute. Contributing research to this report were Li Wei and Kimberly Warren, both senior vice presidents at Global Risk Analytics.