The big ‘if’ remains whether mortgage interest rates will start to decrease

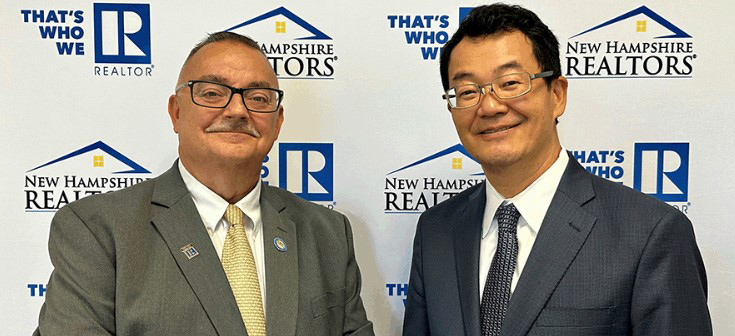

Ben Cushing, left, president of the New Hampshire Association of Realtors, stands with Lawrence Yun, chief economist for the National Association of Realtors, after Yun provided a market update and forecast to Granite State brokers. (Courtesy photo)The chief economist for the National Association of Realtors has predicted for New Hampshire brokers that the squeeze on residential real estate supply will likely ease next year, attracting more buyers to what has been a sellers’ market.

The big “if,” according to Chief Economist Lawrence Yun, is whether mortgage interest rates start coming down from their current rate of more than 8.5% for a 30-year fixed rate.

“You saw a big real estate boom back in 2020 and 2021. But once the Fed started to raise interest rates, as you know, that began to hamper some of the buying activity,” Yun said. “Sales are down about 20% compared to what they were the year before.”

If inflation numbers improve in the months ahead, according to Yun, “that will permit the Federal Reserve to consider cutting interest rates, and then we can look at bringing the mortgage rates down.”

Yun made his remarks at a market update and forecast he provided for the New Hampshire Association of Realtors at its education symposium held last month. Yun summarized his remarks in a video he made with NHAR President Ben Cushing and posted on the NHAR website (nhar.org/news/article/inventory-coming).

Data shows that affordability continues to be a challenge in the New Hampshire residential real estate market. The supply of available houses has been thin, the demand has been high, the prices have been steadily increasing, and interest rates keep climbing.

That all adds up to an affordability index that is as low as it’s ever been: 59, according to NHAR monthly reports.

On the affordability scale, 100 means a potential homeowner in a particular market has enough funds to purchase, mortgage and insure the home. The lower the index, the less affordable the market is.

Through 2023, the affordability index in New Hampshire for a single-family house has declined steadily — from 77 in January to record lows of 59 in both August and September. The affordability of a residential condominium unit is better, but only relatively so, having started at 93 in January and sinking to 71, an historic low, in September.

The median price of a house, according to the NHAR report, was $490,000 in September, just $9,000 shy of the all-time record of $499,000 set in June. Condos, however, did reach a record high — at $405,000 — in September.

On average, homes are on the market for barely a month before they sell — 23 days for a house, 22 days for a condo.

In terms of supply, normally a six-month supply is considered healthy. New Hampshire’s measure in September was 2.0 for a house and 1.6 for a condo.

“I think the elephant in the room now is rising interest rates,” said John Rice, a broker with Tate & Foss Sotheby’s International Real Estate in Rye. “Coupled with modest inventory, I believe they are depressing sales volume. We certainly have the interest if activity at open houses is any indicator. But people have to think twice now about financing.”

Rice keeps the data that are part of a monthly report for the Seacoast Board of Realtors. His September data shows just 58 home sales (the lowest ever for September), producing a median price of $757,500. The median price for a condo in the Seacoast market was $600,000, the highest since January’s all-time record of $661,898.

The Seacoast board takes its data from the sample communities of Exeter, Greenland, Hampton, Hampton Falls, New Castle, Newfields, Newington, North Hampton, Newmarket, Portsmouth, Rye, Seabrook and Stratham.

“Interest rates are definitely a factor in our modest volume numbers,” said Seacoast Board of Realtors President Jessica Ritchie of Great Island Realty in Portsmouth. “But open houses are still crowded, and there is certainly consistent demand for Seacoast real estate.”

Rockingham remains the state’s priciest of its 10 counties with a median price of $620,000 reported in September. The next closest was Hillsborough at $510,000.

At $575,000, Sullivan was the most expensive for condominiums, followed by Rockingham at $487,000.

Joanie McIntire, associate broker at Coldwell Banker J. Hampe Associates in Concord, notes that increased interest rates have a dramatic effect on a new home’s affordability.

“The $400,000 mortgage two years ago with a 3% rate resulted in a $1,600-plus monthly payment. Today’s $400,000 mortgage is now $2,600-plus per month due to the 7% interest rate,” said McIntire, the NHAR’s incoming president for 2024.

Despite the buying challenges, she remains confident that a home investment is worth the effort.

“Purchasing a home continues to be a good investment. Homeownership builds generational wealth. I also believe it helps build strong communities,” she said.

Yun said there is plenty of demand out there. “I believe that there are many pent-up sellers — homeowners who are living essentially in the wrong house, considering life changes, whether they have an additional child in the family, looking for better school districts, people who retire,” Yun said.

Through 2023, the affordability index in New Hampshire for a single-family house has declined steadily, from 77 in January to record lows of 59 in both August and September.