Findings show renters would have to earn 137% of median income to afford a 2-bedroom unit

The pressures of the straitened housing market weigh most heavily on those least able to withstand them: the 1 in 3 households that pay rent.

Introducing NH Housing’s 2023 Residential Rent Cost Survey, Rob Dapice, executive director and CEO, wrote: “To afford the statewide median cost of a typical two-bedroom apartment with utilities, a New Hampshire renter would have to earn 137 percent of the estimated statewide median renter income, or over $70,600 a year.”

Ben Frost, deputy director and chief legal officer at NH Housing said, ”There is so little housing available for rent, and rents are so high I can’t imagine how these families manage to make ends meet.”

Dapice described the rental market as “a bellwether of our state’s housing market,” marked by the strong demand for rental housing and the severe shortage of rental units. The rental vacancy rate has languished below five percent — the sign of a balanced market — since 2009 and below 1 percent since 2021.

This imbalance is mirrored and compounded by the short supply, rising prices and high borrowing costs facing prospective homebuyers, who either remain in or migrate to the rental market. Frost said that “renting down” as prospective homebuyers without sufficient means to compete in the overheated buyers’ market turn to renting, has added to the pressure on the sparse rental inventory.

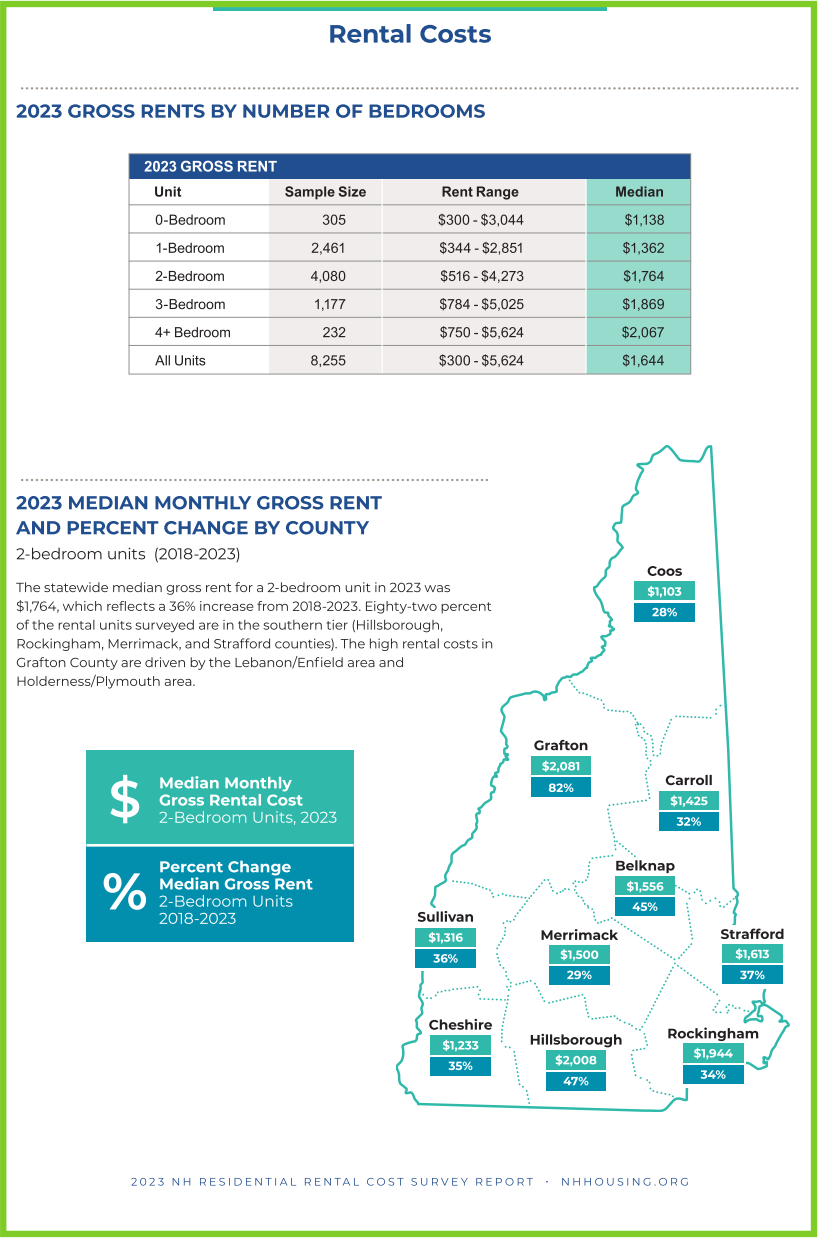

These conditions have sustained an unbroken rise in rents during the past decade, punctuated since 2018 by a sharp increase in median gross rent, which includes utilities, for all units of 40 percent, to $1,644, and for two-bedroom units of 36 percent, to $1,764. While utility costs were relatively stable for nearly a decade, they jumped between 58 and 62 percent in the past year.

Between 2018 and 2023 median gross rents of two-bedroom units rose 82 percent to $2,081 in Grafton County; 47 percent in Hillsborough County to $2,008; 45 percent in Belknap County to $1,556; 37 percent in Strafford County to $1,613; 36 percent in Sullivan County to $1,316; 35 percent in Cheshire County to $1,233; 34 percent in Rockingham County; 32 percent in Carroll County to $1,425; 29 percent in Merrimack County to $1,500; and 28 percent in Coos County to $1,103.

A rent representing no more than 30 percent of household income is deemed affordable. Estimated median renter household income is $51,432, while the median gross rent of a two-bedroom unit is $1,764 — which to be affordable requires an income of $70,600, or 137 percent of median renter household income.

The affordable rent for the same unit to a renter household with median income is $1,286, but only 7 percent of two-bedroom units in the state are listed at or below this rent. In Strafford and Merrimack counties, 12 percent and 10 percent of two-bedroom units rent for an affordable rate, while no more than 6 percent are available in the other eight counties, and there are none at all in Carroll County.

NH Housing reported that in 2020, of the estimated 155,277 renter households, 41,283 had income of less than $25,000, 42,293 or 27 percent, had income of between $25,000 and $50,000, and 29,691 or 19 percent had income between $50,000 and $75,000.

The NH Fiscal Policy Institute has estimated that in 2021 nearly half of renter households with incomes of less than $35,000 paid more than half their income in rent, and another 29 percent paid between 30 and 50 percent in rent.

Reports showing that, since June 2020, the median sale price of single homes has risen almost 50 percent to $495,000. Nicole Heller, senior policy analyst at the NH Fiscal Policy Institute, reckoned that, with a 30-year mortgage with a fixed rate of 6.7 percent, a 5 percent down payment of $24,750 and property taxes of $7,470, a New Hampshire household with the median income of $88,465, could own that median-priced home for just $3,656.92 a month — merely half their monthly income.

“We need more houses,” Frost said flatly, noting that the current shortfall in housing stock of all types is more than 23,000 units, a number projected population growth is expected to reach 90,000 by 2040.

“There’s always hope,” Frost remarked. He said this year the Legislature took several steps designed to expand the housing stock. A $25 million appropriation to the Affordable Housing Fund, administered by NH Housing, provides funding for low interest loans and grants to construct, acquire or rehabilitate housing affordable to families of low and moderate means.

The Housing Champion Program will reward and recognize municipalities that tailor zoning ordinances and building regulations to facilitate residential development. A $5 million appropriation will fund a grant program to assist municipalities with the process.

Finally, the Legislature convened a Special Committee on Housing, composed of state and municipal officials, developers, contractors and housing advocates to address the challenge.

As Dapice said, speaking on WMURTV, “We’re already experiencing economic consequences and humanitarian consequence of the supply and demand imbalance in the housing market, and those are going to get more severe if we don’t do something.”

Meanwhile, homeowners, whose median income is twice that of renters, find themselves in an enviable bind. The median price of single-family homes reached $495,000 this month. On the one hand, they can sell their single-family home and buy another, if they can find something they can afford, or downsize by buying a condominium, which has a median price of $400,000. On the other hand, they can sit tight as their equity grows.