As state’s rental market remains red hot, need for affordable units grows

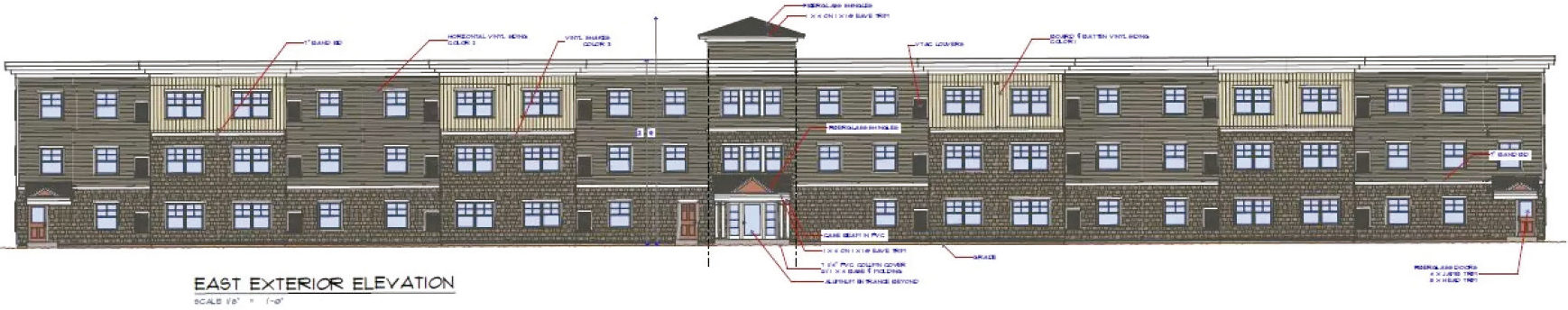

A

rendering of CATCH Neighborhood Housing’s newest affordable

development, planned in Concord, which was recently awarded $750,000 by

the state through a competitive grant program. (Courtesy photo) Real estate often involves imagination.

For example, right now, a 6.5-acre lot sitting across from the Sam’s Club on Sheep Davis Road in Concord doesn’t look like much.

“It’s simply a raw piece of land that is heavily wooded,” Thomas Furtado, the CEO of CATCH Neighborhood Housing, a nonprofit that develops affordable housing units in Merrimack County, admitted.

But

Furtado has vision: In a year and a half from now, he says, this lot

will be home to 48 families. “And that’s something we are very proud

of,” he said.

CATCH

was recently awarded $750,000 through the InvestNH program, a $100

million initiative funded with federal Covid-19 stimulus money and

championed by Gov. Chris Sununu as a means of chipping away at the

state’s acute housing shortage.

Half

of the overall fund — $50 million — was recently awarded in the form of

grants or no-interest loans to developers to fill in funding gaps as

they develop projects that include affordable rental units.

The

project on Sheep Davis Road, once complete, will rent out units

starting at around $1,200 for a one-bedroom and around $1,600 for a

two-bedroom, which is well below market rate. And a lot of people with

in-demand jobs will be eligible.

“This

is the new police officer, the new teacher in the school department,

the new restaurant worker,” Furtado said of his future tenants. “There

are a whole bunch of people who qualify for affordable housing, and I

think that’s shocking to many people.”

Each

of the 30 InvestNH grant winners includes at least some “affordable”

units, but the price of rent for those units will vary across each

project. The InvestNH program calculates affordable rents based on

regional housing costs and area median incomes, and some projects might

set rents lower in order to capitalize on other public-funding

incentives.

And the

one-time government subsidies from the InvestNH program come with some

strings: Units must remain affordable for a minimum of five years, and

they have to be ready for tenants to move in within 18 months.

Builders

receiving this funding, which include some of the largest private

developers in the state, said it is necessary given the hesitancy on the

part of some banks to loan money for workforce housing projects, and

soaring building costs due to inflation.

Historically,

there have been other hurdles in building affordable renting housing as

well. Local residents and town officials sometimes push back against

proposed developments with concerns about school overcrowding, traffic

or claims it will change the character of the town.

Big

picture, this is part of why New Hampshire has dug itself into such a

housing hole. Just ask Christopher Fokas, part of the team behind

Wallace Farms, a 240-unit project in Londonderry where half of the

apartments have capped rents based on affordability.

“The approval process took about four years and was immensely expensive,” Fokas said.

Wallace

Farms just received an InvestNH grant to complete the final units, but

Fokas said raising the rest of the money needed to pull it off while

managing the preferences of local officials hasn’t been easy. “It’s

complicated, it’s costly, and I think it deters developers from doing

it, quite frankly,” he said.

Developers

pursuing housing projects with affordable units can also struggle to

secure bank funding, as financial institutions might be hesitant to

commit to funding a project that’s predicated on lower rents. That’s

another reason why those behind the InvestNH program say its subsidies

are so helpful.

“Banks

don’t get free money. They need a return on their investment,” said Rob

Dapice, director of New Hampshire Housing, a quasigovernmental agency

that’s helping to administer the InvestNH program. “As a result, there

is just no way to make the numbers work for affordable rental housing

without some subsidy.”

Elissa

Margolin, director of the advocacy group Housing Action New Hampshire,

said the InvestNH model of giving builders grants or cheap loans makes

sense in the current environment. Ideally, she said, that helps

developers pass along their savings to tenants in the form of lower

rents, “and that’s a really important tool in the toolbox to try and

claw our way out of this crisis.”

Developer

Tom Monahan has been working to bring a new housing project in Exeter

to life for years, and the InvestNH funding is helping him get closer to

the finish line. Once completed, the Gateway at Exeter will have 224

rental units, including 56 that are price capped.

Monahan

recently received $3 million in InvestNH funding, but that only covers a

small portion of his ballooning costs. “Lumber, nails, concrete,

sitework, went from $39 million to $52 million,” he said.

And

soon, Monahan will be placing orders for 224 refrigerators. He hopes

they’ll be delivered a year from now, just in time for the apartment

doors to open up to working families.

This article is being shared by partners in The Granite State News Collaborative. For more information, visit collaborativenh.org.