New data shows that New Hampshire residential property owners are among the most “equity-rich” in the nation, although the overall trend shows the state’s real estate market is on track to erode at least some of those gains.

According to ATTOM, a curator of real estate data nationwide, in the third quarter 55.1 percent of homeowners in the Granite State were considered “equity-rich,” meaning the combined estimated amount of their loan balances is no more than 50 percent of the property’s estimated market value. That puts the state 13th in the nation.

In the second quarter the state ranked 15th, with 54 percent of homeowners deemed equity-rich.

Among the 10 counties, Carroll had the highest percentage of equity-rich homeowners, while Hillsborough had the smallest percentage of homeowners who are underwater.

By county, here are the percentages of homes seriously underwater and equity rich:

• Belknap, 1.4 percent, 63.5 percent

• Carroll, 1.0 percent, 69.5 percent

• Cheshire, 1.7 percent, 52.2 percent

• Coos, 2.3 percent, 62.2 percent

• Grafton, 1.7 percent, 59.5 percent

• Hillsborough, 0.9 percent, 51.9 percent

• Merrimack, 1.3 percent, 52.7 percent

• Rockingham, 1.0 percent, 54.8 percent

• Strafford, 1.5 percent, 51.7 percent

• Sullivan, 1.5 percent, 57.2 percent

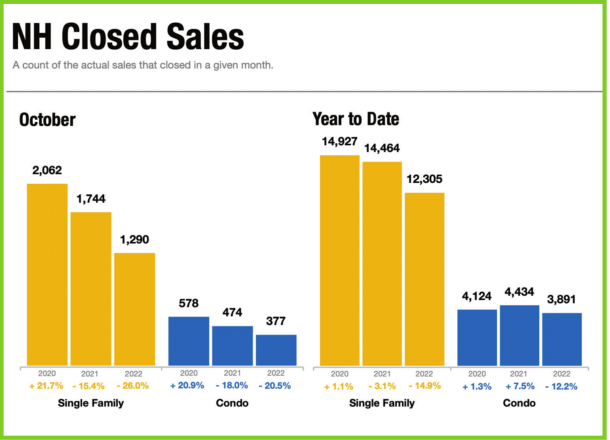

But market forces — rising interest rates, in particular — threaten home equity and are cooling New Hampshire’s long-running red hot real estate market. That is evident in the most recent sales data from the New Hampshire Association of Realtors.

There were 1,290 closed single-family home sales in the state in October, according to the NHAR report, down 26 percent compared to the 1,744 sales a year earlier and 20 percent lower than the 1,608 sales recorded in September. There were 377 residential condominium sales, down from 478 in September and 467 in August.

Sales volume was also down in October, falling 11.1 percent from last year to $705.9 million for single-family homes and by 6.3 percent to $155.9 million for condos.

Another indicator of a slowing market is that properties are staying on the market longer — 27 days for a single-family and 22 for a condo in October, compared to 23 and 17, respectively, in September.

— PAUL BRIAND