Flat rate seen as ‘healthy direction for the market’

Empty space inside office buildings in New Hampshire — currently standing at 11.4 percent — isn’t likely to change much in the near future as companies come to terms on how much the pandemic changed employees’ work habits.

For a third consecutive quarter, the vacancy rate of offices stayed relatively flat, rising by only 0.2 percent since last year and ending the second quarter of 2022 at 11.4 percent, according to a new report from Colliers International, which has commercial real estate brokerage offices in Manchester and Portsmouth.

The most significant data point in the report, according to its author, Colliers research manager Kristie Russell, is that the overall vacancy rate went up by 4 percent compared to the pre-pandemic second quarter of 2019.

“This steep incline was due to some companies downsizing their office space, notably in the Class B sector,” she wrote in her analysis.

Meanwhile, the industrial sector tightened with an overall vacancy rate that declined by 1.7 percent and with asking rents rising by 28.3 percent.

Class A office space is considered the best in a mar ket, often newly constructed and the most expensive, while Class B might be of somewhat less quality but also less expensive to lease. In many cases, a Class B office building was originally Class A, but has been downgraded due to age and deterioration.

The pandemic had a direct effect on the office building market, not only here but everywhere. At the height of the pandemic, given Covid’s highly contagious and potentially deadly consequences, just about no one came to their offices to work, connecting instead remotely from home.

As vaccines took hold and people became more willing to be in public again, workers started a return to the office — some full time, some a couple or few days a week, while other workers decided to do their work remotely full time.

The office market in New Hampshire saw the effects of these decisions.

“A lot of those companies have decided to go to full-time work-from-home,” said Russell. “Part of the unknown for the direction of the market is for those companies that decided to do a hybrid model — some days in the office and some days at home. Depending on how the companies feel this policy works, companies could shrink their footprints more, or if they decide the model doesn’t work for them or certain employees, they could keep their footprint.”

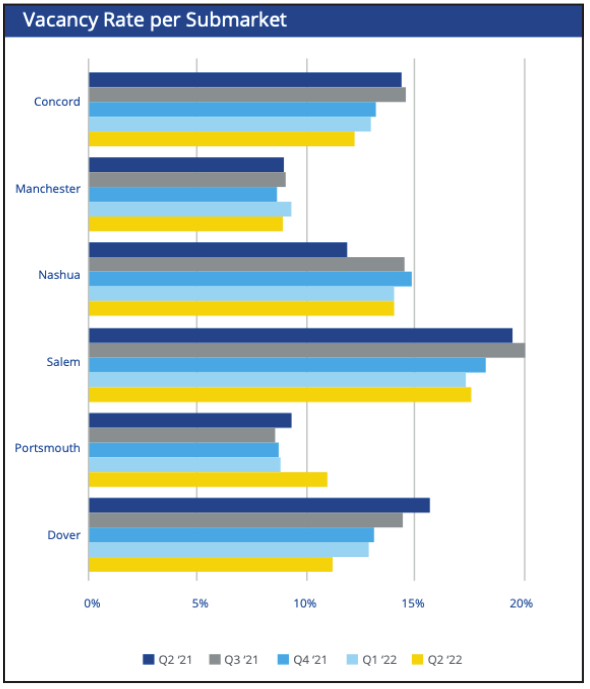

Colliers looked at the trends in six areas of the state (called submarkets): Concord, Dover, Manchester, Nashua, Salem and Portsmouth.

Russell cited the following examples of downsizing:

• In the Concord submarket, over 200,000 square feet was added to the vacancy rolls when Lincoln Financial Group and Cigna vacated their New Hampshire locations.

• In the Manchester submarket, Southern New Hampshire University relocated from roughly 138,000 square feet in various locations and consolidated into its 190,000-square-foot Millyard building in Manchester.

• In the Nashua submarket, Dell Technologies downsized its in-office Granite State presence, vacating 198,000 square feet.

• In the Portsmouth submarket, while there were no large blocks added, there were roughly eight 10,000-square-foot locks added in different buildings by various companies vacating space.

Here’s where the vacancy rates stand in each submarket as of the end of the second quarter, from high to low: Salem 17.6 percent, Concord 12.2 percent, Nashua 14 percent, Dover 11.2 percent, Portsmouth 11 percent and Manchester 8.9 percent.

The Colliers report also looked at cost, using modified gross (MG) in its analysis.

MG refers to a specific type of lease in which the tenant pays a defined base persquare-foot rate at the start, but in subsequent years will pay a slightly different amount based on expenses such as property taxes. This base rental rate will fluctuate, because property taxes and other maintenance fees change over the course of a lease term.

The average rents in each submarket as of the end of the quarter were: Portsmouth $25.78, Salem $23.92, Concord $20.09, Manchester $19.54, Nashua $18.19 and Dover $15.22.

According to the report, rents overall in the state finished the quarter at $19.93 modified gross, climbing for the fourth quarter in a row and increasing by 8.5 percent (65 cents per square foot) yearover-year.

The report also looked at “absorption rate,” a measure of new square footage leased by tenants.

Three New Hampshire submarkets had absorption gains, while three had losses. Manchester gained 34,172 square feet, Dover gained 27,268 square feet, and Concord gained 17,181 square feet, while Portsmouth lost 98,008 square feet, Salem lost 3,050 square feet, and Nashua lost 719 square feet.

While the New Hampshire office market hasn’t fluctuated much in terms of vacancy, that’s not to say the market has been inactive, according to Russell.

“There was ample activity with investors and owner-users acquiring buildings, as well as tenants growing into more space,” she said.

Among the deals cited in the report was Duprey Companies’ purchase of 1 Granite Place in Concord for $7.2 million and Precision Talent Group’s purchase of 7 Wall Street, Windham, for $3.1 million.

Notable lease agreements included ConvenientMD’s decision to move its corporate headquarters from the Pease International Tradeport to West End Yards in Portsmouth, and Degree Control’s move of its headquarters from Milford to Innovative Way in Nashua.

The fact that the vacancy rate has remained flat is actually a good sign, according to Russell.

“This means there is just as much space being leased as vacant space hitting the market over the last few quarters. This is a healthy direction for the market,” she said.

“The long-term outlook is still unknown,” she added. “Many of the larger companies have made decisions about whether to stay in their space, change their footprint or close offices altogether. Although, we could see some more impactful changes,” she added. “Typically lease terms can range from three to 10 years. It may be another couple of years before the market sees the final impact of the pandemic as companies make decisions about lease renewals.”

On the industrial side, according to a separate Colliers report, the sector saw about 1 million square feet of new construction over the last couple of years with the warehouse/distribution sector contributing the most to the shift, rising by 2.6 percent compared to 2019.

Tenants, Russell wrote, “were either new to NH or stayed and expanded, which is a positive sign for the state — increasing jobs, revenue, etc. However, this activity led to a dramatic drop in the vacancy rate, making it difficult for other industrial companies to expand.”

The squeeze on supply increased demand, which, in turn, led to price increases. Rents rose from $7.92 per square foot in the second quarter of 2021 to $10.17 in the second quarter of this year. Rents in this sector are mostly triple net (NNN), meaning that the owner on top of the base rent also passes the operating costs on to the lessee.

Here are the vacancy rate and average NNN rent in each of the state’s submarkets:

• Concord 3.9 percent, $6.46

• Dover 5.2 percent, $11.68

• Manchester 0.4 percent, $12.75

• Nashua 4 percent, $7.86

• Portsmouth 1.1 percent, $11.81

• Salem 10.2 percent, $11.90

“The positive from the rent jump was that it led construction to pick up, for both owner-users and investors,” wrote Russell. “Compared to three years ago, the warehouse/distribution inventory increased by 670,600 SF with another 280,500 SF under construction this year.”