PROPERTY VALUES

Every year, each New Hampshire town and city taxes property owners within its borders based on the assessed value of their real estate. Because towns reassess property values in different years, the NH Department of Revenue Administration conducts an annual equalization survey to determine how far local assessments might vary from actual market value in each municipality. DRA annually publishes a report on the true market value of properties in each town. That report includes a total for the entire state.

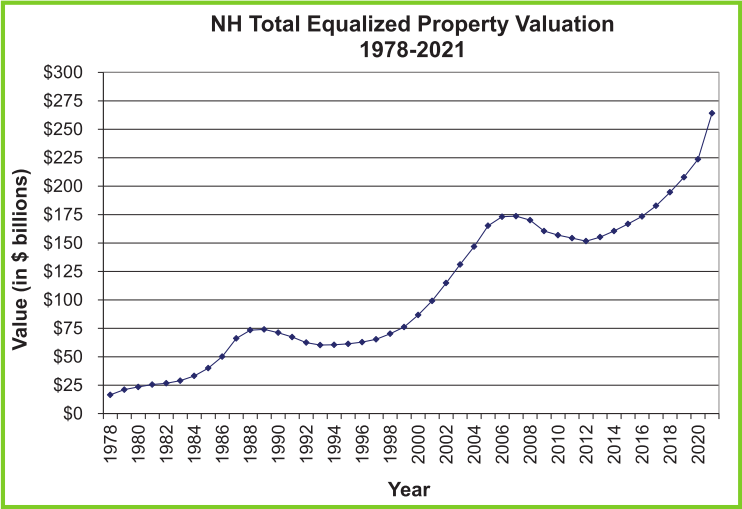

For calendar year 2021, DRA states that the total equalized value of New Hampshire properties was $264,083,869,873. That is $40 billion more than in 2020.

Sometimes one can learn important lessons by looking at how important economic factors change over time. DRA’s reports provide an annual picture but no sense of what changes have happened.

In 1978, the total equalized value of all New Hampshire real estate was only $16,507,327,532, less than 7 percent of the 2021 value.

Total property values increase for two main reasons: (1) new construction adds to the tax base, and (2) unchanged properties change in value because people are willing to pay more (or maybe less) for them.

The chart shows the total equalized valuation of New Hampshire properties for every year from 1978 through 2021. Twice during this period property values peaked and then collapsed.

Real estate price bubbles

hit their peak in 1989 and 2007-08. In both cases after the bubble

burst, values declined for five consecutive years, and it took 10 years

before the total value finally exceeded the peak year of the bubble.

Are

we to see a third bubble burst? If so, is it likely that it will again

take 10 years to recover? What will be the implications?

Doug

Hall, a resident of Chichester, is a former state representative and is

a member of the board of the NH School Funding Fairness Project.