Demand remains high as lack of inventory continues to fuel record prices

‘It’s still a sellers’ market in the sense that they’re getting top dollar for their home,’ says Adam Gaudet, president of the NH Association of Realtors.

As home prices in New Hampshire continue to break records, the president of the NH Association of Realtors doesn’t think the market — which is heavily weighted in favor of the seller — is about to change.

“I do not see that happening in New Hampshire anytime soon, certainly not in 2022,” said Adam Gaudet, NHAR president and owner/broker of 603 Birch Realty in Concord.

“It’s still a sellers’ market in the sense that they’re getting top dollar for their home with offers that often include appraisal gap coverage and/or waiving inspections,” Gaudet said. “Most sellers are still getting multiple offers and over-asking purchase amounts.”

The ingredients for a sellers’ market have been a part of the New Hampshire residential real estate mix now for several years, even preceding the Covid-19 pandemic but certainly exacerbated by it.

The popularity of a given state — or a particular area in that state — drives demand. If supply can’t meet the demand, prices rise. And New Hampshire’s supply of residential real estate has been at historic lows.

“The lack of inventory continues to drive up prices and limit our number of sales,” said Gaudet. “The demand for a home in New Hampshire far exceeds the supply.”

One area where the sellers’ market has been most evident is the Seacoast, which has the most expensive homes, in terms of median price, than anywhere else in the state.

But there has been talk nationally that rising interest rates for mortgages are slowing demand in some areas of the country.

‘Very active market’

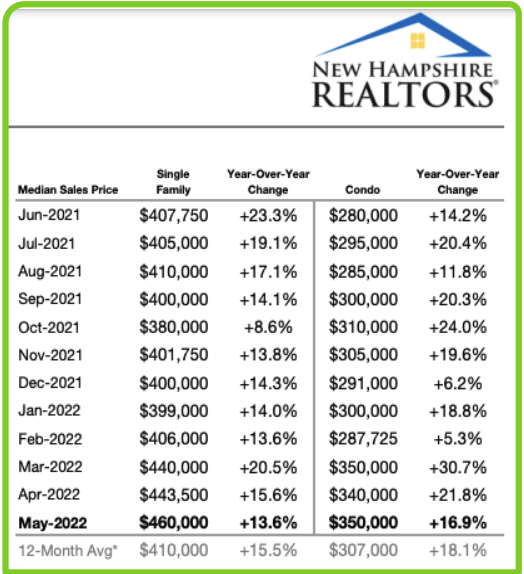

The numbers tell the story. In May, the statewide median price of a single-family home was $460,000, according to the NHAR. That is a record high, and it comes after previous record highs in April and March of $440,000. Over the last decade, a home’s median price in the state has more than doubled.

The median price of a residential condominium in May was $350,000, equaling the record-high first reached in March of this year.

One reason it’s difficult to buy a home here is because they go so quickly. A data point called days on market is the average number of days it takes for a property to sell. In New Hampshire for May, it was 17 days for a singlefamily home, 15 days for a condo unit, according to NHAR data.

Of the 10 counties in the state, the most expensive county in which to buy a single-family home — as it has been for the last several months — is Rockingham, where the median price clocked in at $589,000. The next closest was Hillsborough at $486,000.

Within Rockingham County, the Seacoast area is even pricier still.

In May the median price of a home in Rockingham County was $650,000, up $25,000 from last year, but well off the all-time high of $682,500, which was set in March, according to the Seacoast Board of Realtors’ latest monthly report.

For a residential condominium on the Seacoast, the median price was $615,000, an all-time monthly median price record, crushing the old record of $552,500 set in January.

“We continue to experience a very active market despite challenges in inventory levels,” said Jessica Ritchie, board president and a broker with Great Island Realty in Portsmouth. “Even as we experience an uncertain national financial picture, buyers continue to see strength in their real estate investment.”

Months’ supply of inventory hit an all-time low in May, hitting 1.1 months. Months’ supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace. A healthy months’ supply is six months.

At the end of 2022’s first quarter in April, Fannie Mae’s chief economist said that inventory shortages, high prices and rising interest rates pointed to a shift away from a sellers’ market.

“A sharper downturn in residential investment is now underway, and we will likely be revising downward our nearterm home sales forecast,” said Doug Duncan, chief economist at Fannie Mae.

Gaudet doesn’t see that the creep in interest rates is dramatically affecting sales in the Granite State.

“Yes, rates have gone up, but they’re still low when compared to what they’ve been over the past few decades. We’ve just gotten used to seeing them go down over the past decade,” he said. “I think until rent prices are sorted out, more people will continue to turn toward owning their own home; it just makes more financial sense for most people.”

But nationwide, lenders are writing fewer mortgages.

In a June report, ATTOM, a leading curator of real estate data nationwide for land and property data, said that lenders issued $892.4 billion worth of mortgages in the first quarter of 2022, down quarterly by 17 percent and annually by 27 percent.

“The drop-off in Q1 refinancing activity is no surprise with mortgage rates rising as rapidly as they have,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “But many forecasts expected purchase loans to remain strong in 2022, and even increase in both the number of loans originated and the dollar volume of those loans. The weakness in purchase loan activity shows just how much of an impact the combination of escalating home prices and rising interest has.”