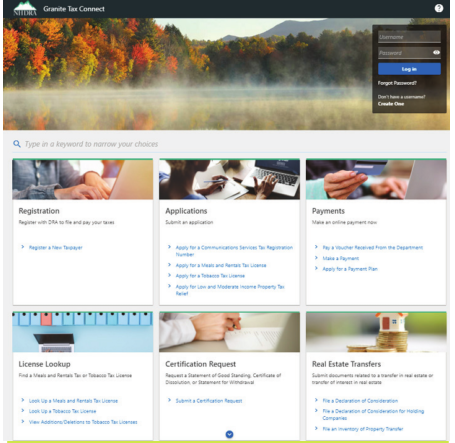

The New Hampshire Department of Revenue Administration has launched the third and final phase of Granite Tax Connect, its new online user portal and revenue management system.

Granite Tax Connect allows taxpayers, tax professionals and DRA customers to manage multiple accounts, file and amend returns, view balances, schedule payments, view correspondence, register new accounts, check the status of returns and payments, request refunds and credits, and update information.

Since its launch, more than 19,000 taxpayers and their practitioners have enrolled in the online portal, the DRA said. With the completion of the third phase, all 148,000 payers and preparers of a range of state taxes are eligible to enroll.

The revamp of the agency’s revenue management system — the first major effort of its kind in over 30 years — began in 2019 with the launch of an online user portal for payers and preparers of a limited number of state taxes, followed in 2020, when the portal was expanded to the payers and preparers of the state’s largest revenue-raiser, the business profits tax, business enterprise tax, and interest and dividends tax.

In this last phase, the remaining four state taxes — including the tobacco tax, real estate transfer tax and utility tax — can be accessed online by payers and preparers.

DRA Commissioner Lindsey Stepp called the completed GTC launch “a success for our taxpayers, providing them with a more streamlined, user-friendly process.”

More information is available at revenue.nh.gov/gtc. — JEFF FEINGOLD