Treating your business as if it is going to be sold in the near term can be a powerful force to harness – and drive improved performance. When a business owner decides it is time to sell, they generally engage a team of professionals to help secure the best possible value for the business. These professionals help prepare the business for sale: collecting documentation on key processes and value drivers, developing marketing and sales studies, uncovering areas of risk to be mitigated, assessing employment contracts and business relationships. All of this effort takes time and money, and is designed to have a positive impact on the ultimate sale price. What if the business owner doesn’t want to sell any time soon? Can you still harness that positive energy to improve business performance now? The answer is yes.

Just like a diet, the best time for business owners to begin preparing was last year. The next best time to start is right now. Preparing as if you are going to sell the business will help identify gaps and weaknesses that can be addressed in a proactive manner.

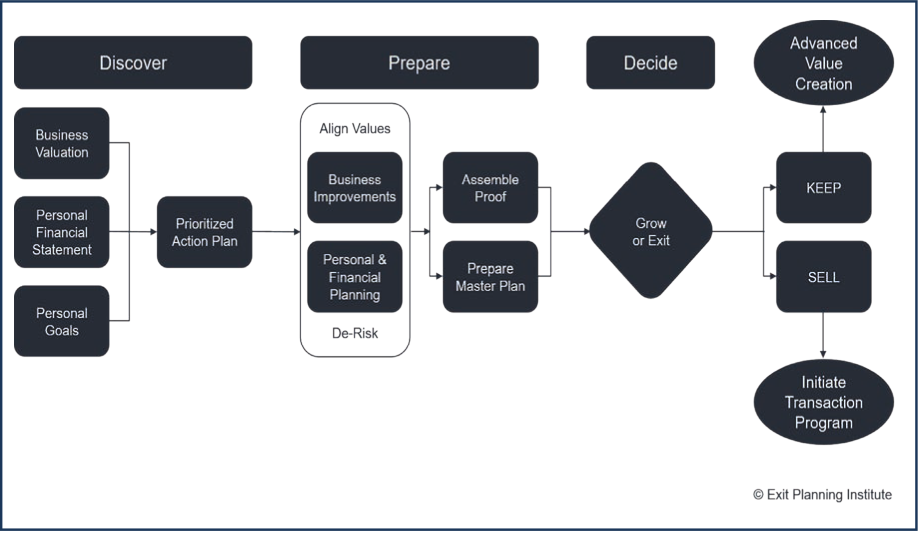

Value Acceleration

The value of a business is influenced by the amount of cash flow the business generates times a multiple. This multiple reflects many factors, including business and industry risk. The business owner who approaches their business with the mindset of increasing cash flows and reducing business risk will, over time, enhance the value of their business. The increased value will be obvious from the improved cash flows available to owners. They will also be able to sleep easier knowing potential business risks are greatly reduced.

We find the most successful

and sustainable way to achieve these advantages is through a

disciplined approach known as Value Acceleration. The Value Acceleration

model has three stages: Discover, Prepare and Decide.

Discover

In the Discover stage, business owners take inventory of their

personal, financial and business goals. These objectives are the

“threelegged stool” of Value Acceleration. Owners should look for and

note ways to increase alignment and reduce risk. The purpose of the

Discover stage is to gather data and assemble information into a

prioritized action plan.

Prepare

In the Prepare stage, business owners follow through on business

improvement and personal/financial planning action items identified

during the Discover stage. Examples of action items may include:

• Addressing weakness identified in both business and personal financial planning

• Protecting value through planning documents and making sure appropriate insurance is in place

• Analyzing and prioritizing projects to improve the value of the business

• Developing strategies to increase liquidity and retirement savings

Ideas for business

improvement are often uncovered in the Prepare stage of the Value

Acceleration process. The Prepare stage focuses on how to align values,

decrease risk and increase the intangible value of the business.

During

this process, we often use a combination of benchmarking and

observation to determine where the biggest performance gaps (or areas of

opportunity) are within the business.

Decide

The last stage is the Decide stage. At this point, business owners can

choose whether to grow their business or sell it, and which liquidity

options are available for each path.

While

it may seem counterintuitive, we find that it is best to delay the

decision to grow or exit until the very end of the Value Acceleration

process. Many surveys and studies have been conducted that support the

idea that business owners don’t explore their exit options deeply enough

before committing to a transaction – leading to deep dissatisfaction

with the outcome. After identifying and implementing business

improvement and risk reduction projects, owners may find themselves more

open to keeping their business and using it to build liquidity while

they explore other options.

The

Value Acceleration process is a valuable framework for business owners,

management and their advisors. We have found that through the Value

Acceleration process, clients are able to increase business value and

liquidity, giving them control over how they spend their time and

resources.

Have

questions about the value of your business? Our credentialed business

valuation specialists bring clarity to the complexities of valuation.

Contact us or visit berrydunn.com/ valuation.

Ryan T. Warren, rwarren@berrydunn.com Sno L. Barry, sbarry@berrydunn.com

1000 ELM STREET, 4TH FLOOR MANCHESTER, NH 03101 (603) 518-2600 • BERRYDUNN.COM