About this webinar:

Want to protect your assets, ensure your family is secure and enjoy your retirement years in comfort? Start planning now.

While many people wait until a major life change to begin estate planning or think that a will is only necessary for people with a high net worth, making a financial plan is essential – regardless of age or assets.

Join our expert panel to discuss four pillars of estate planning: from wills, to health care proxies, to powers of attorney to revocable trusts. They’ll demystify the process and the terminology and explain why making these plans now is important for you and your family.

Most importantly, they’ll show you how to get started.

What you’ll learn from this webinar:

- Who should have a will or an estate plan?

- What happens to my assets if I die without a will?

- What doesn’t a will do?

- What is probate? Should I try to avoid it? How?

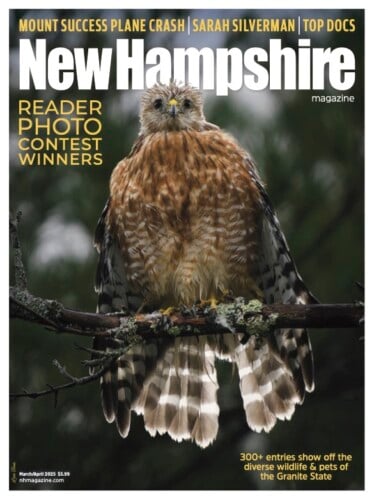

- Are there any estate planning strategies unique to someone living in New Hampshire?

Meet our panel of experts

Benjamin Siracusa Hillman, Esq.

Benjamin Siracusa Hillman, Esq.

Chair, Trusts, Estates, & Guardianships

Shaheen & Gordon, P.A.

Benjamin Siracusa Hillman is a partner at Shaheen & Gordon, P.A. He practices in the interrelated areas of estate planning, probate litigation, and elder law (including Medicaid eligibility). Ben assists clients with simple and complex estate planning, focusing on the needs of the elderly, retirees and near-retirees, high net worth clients, clients with special needs, same-sex couples, and young families. Licensed in New Hampshire, Massachusetts, and New York, Ben can advise clients whose personal affairs spread across multiple states.

Whitney A. Gagnon, Esq.

Whitney A. Gagnon, Esq.

Attorney, Trusts and Estates Department

McLane Middleton

Whitney focuses her practice in the areas of estate planning, trust administration, and elder law. As an attorney in the firm’s Trusts and Estates Department, Whitney advises individuals and families and assists in establishing comprehensive estate plans. Whitney’s estate planning practice ranges from preparing foundation estate plans for young families to designing and implementing complex plans that incorporate sophisticated estate, gift, income, and generation skipping transfer tax strategies.

Thanda Fields Brassard, JD

Thanda Fields Brassard, JD

Vice President & General Counsel

Fiduciary Trust of New England

Thanda advises individuals and families on their estate and tax planning matters, and has significant experience in estate settlement and trust administration. She has played an instrumental role in educating those outside of New Hampshire in the benefits of the state’s trust laws, and has helped Fiduciary Trust of New England become the premier independent provider of New Hampshire trust services. Thanda is also experienced in estate planning for non-traditional families.

Thanda is active in the professional community and is a member of the New Hampshire Estate Planning Council and the New Hampshire Bar Association, and has been recognized with multiple industry awards in the legal and professional services community. In addition, she is an Accredited Estate Planner and has written and spoken extensively on trusts and estate planning.

Thanda is involved in community service, serving on the boards of the Ellie Fund, Judge Baker’s Children’s Center, and Frederic E. Weber Charities Corporation (also as President). Thanda earned a BA from Boston College and a JD from Boston College Law School.