Even in the midst of a pandemic, New Hampshire remains a desirable location for companies selling globally, according to a report prepared by Plymouth State University.

The 2020 globalization report, presented virtually Jan. 19, points to the resiliency of the state’s high-technology and advanced manufacturing industry clusters and its geographical proximity to regional markets.

In their study, Professors Roxana Wright and Chen Wu examined publicly available international business activity by Granite State firms as well as in-state business activity and acquisitions by foreign firms, from March 2020 through the end of the year.

The report revealed “25 notable investment and expansion projects or activities initiated by or involving foreign firms” in 2020, as well as five acquisitions involving foreign and New Hampshire-based companies, seven production or service expansion investments or new contracts, 10 distribution agreements or actions, and three new product launches and supply chain actions.

That accompanied the steady recovery of state exports, which dropped 13% from March to May 2020, but bounced back in the third quarter as world economies reopened, reaching $4.9 billion in November 2020 — although that was still a 6% drop from the $5.3 billion in November 2019 exports. One commodity, however, industrial machinery exports, rose 6.4% in 2020.

That activity, they say, shows the strength of New Hampshire’s industrial supply chains and appeal to foreign companies interested in gaining access to the U.S. market as well as expanding their offerings through acquiring innovative products and processes in New Hampshire.

And the state could be well positioned to further grow these sectors and attract more international interest.

There is “a good deal of activity, a good deal of expansion” in some sectors, said Taylor Caswell, commissioner of the Department of Business and Economic Affairs, during the presentation. “On the recruitment side, it’s safe to say it’s never been busier. Companies in manufacturing, particularly in the life sciences industry, in the high-technology industries, are demonstrating they find value in New Hampshire and continuing to make investments.”

Companies from the U.K., Canada, Germany, Switzerland and France are traditional markets that inquire about New Hampshire’s business environment, said Tina Kasim, program manager of the Office of International Commerce, who also took part in the presentation. “We are starting to see interest from countries such as India. There is a lot of work we have to do to address these markets and introduce them to the state.”

Supply chain resiliency

The timing may be ideal for promoting New Hampshire to foreign businesses looking to regionalize their supply chains, says the report.

“We found some evidence to suggest some companies are considering shifting production,” said Wright.

Some 25% of expansion agreements tracked in the report are specifically related to supply chain management.

Domestic and international high-technology and advanced manufacturing firms with a New Hampshire presence are utilizing partnerships and acquisitions to develop their supply chains, according to the report.

“A lot of these projects and activities we looked at did address something in the supply chain. There was something in there formalizing a supply chain partner that wasn’t formalized before,” said Dr. Wright. “Maybe a company was trying to pull more product or new product through an existing supply chain, and they needed to formalize that agreement with supply chain partners.”

This trend was in motion before the pandemic

“From 2018 to today, we’ve seen so many challenges to the worldwide globalization process, and also in economics we saw researchers are looking at the change in (supply chains) from the traditional globalization model that everyone works with to a new model (of selecting a) group to work with, and those partners showed a tendency to be the regional partners,” said Dr. Wu.

When the pandemic hit, researchers speculated “the pandemic destroyed globalization,” said Dr. Chen, but their researched showed “foreign (companies are) still investing in the U.S. and (U.S.) companies are still exporting.”

Instead of one strategy over another, companies will likely have to navigate having both a regional and global supply chain, with redundancies to circumvent material or component shortages.

“You have to do both,” said Tom Taylor, CEO of Foxx Life Sciences, which has manufacturing facilities in Salem and Londonderry as well as its Asian headquarters in India. The company manufactures 95% of its singleuse laboratory equipment in New Hampshire, and added personal protective equipment to its product offerings last year.

“We have put a lot of investment into local manufacturing and local supply chains wherever we can do that, but then there are particular products where either the technology is outside of the U.S. or cost structure of that component is cheaper outside the U.S.,” said Taylor. “Carrying a little extra inventory may not make your CFO happy or bank happy, but it resolves the issue of going out of stock. And that’s been one of our key strategies this past year.”

Manchester-based Jewell Instruments, which sells rail components for metros around the world, has also had to shift 10% more of its manufacturing to the Bahamas and has been upping its inventory to support “some of our markets that really demand off-the-shelf type of service,” said Brian Ward, vice president of sales. “They want the products within two weeks.”

It was actually “the trade wars (that) impacted us more in the supply chain than Covid,” said Ward, whose company decreased domestic production from 65% to 55% as a result. Having been forced by tariffs to secure pricing with suppliers and work around supply chains issues has given the company “a resilient supply chain now.”

Industry clusters, such as aerospace and defense and life sciences, will make the state a favorable location for shortened, regionalized supply chains.

Despite the closure of the U.S.-Canadian border to nonessential travel since March 23, 2020 — which has negatively impacted exports and cross-border business activity — the advanced manufacturing and high-technology sectors have demonstrated resiliency through the pandemic, said Dr. Wright.

Businesses are looking to the long term as they plan. Both Foxx and Jewell’s representatives expressed optimism that business will tick up in the second half of 2021, as global travel opens up with the administering of the Covid-19 vaccine.

More than half of the expansion agreements tracked in the report are multiyear arrangements.

“Regionalization is one of those gears, and obviously New Hampshire is doing well from that perspective because we’re close to Canada, we already have strong strategic investing firms in New Hampshire, and already have an established supply chain that’s regional and national. We also have some industries that are relying on innovations or processing that are regional,” said Dr. Wright.

Opportunities and concerns

A year from now, Drs. Wright and Chen will reexamine international subsidiaries in the state to determine growing industries and the economic impact of foreign direct investment in the state since they first tracked 453 international subsidiaries owned by 186 companies from 24 countries in 2018.

Speaking anecdotally of the business activity tracked over the past year, Dr. Wright suspects energy and life sciences are promising industries.

Caswell noted, New Hampshire is “heavily engaged in an effort with Maine and Massachusetts to bring the offshore wind industry to the Gulf of Maine.”

“We’ve seen, obviously, over the last couple of years, that industry is growing substantially in southern New England and the Mid-Atlantic region,” he said.

New Hampshire’s officials are not only interested in the job growth it would create, but also the opportunity to drastically increase Northern New England’s energy access.

“We are at the end of every wire and pipe in New England,” said Caswell. “We need to increase our access to energy, and if we can do that in ways that are renewable and scale this offshore wind, we’re talking gigawatts instead of kilowatts.”

The state has been working with the U.S. Bureau of Offshore Energy Management in Washington. The work has been slowed down by the pandemic, but there remains “great potential,” said Caswell.

“On the transportation side, there is a huge amount of technology that has infiltrated many sectors; it’s just starting in transportation,” said Caswell, naming smart roads, self-driving cars, automating the movement of commercial goods and even the passage last year of HB 1517 — which lays out protocols for registering, inspecting and plating “roadable aircraft,” otherwise known as flying cars “There is a huge industry growing behind (transportation technology),” said Caswell. “The number of inquiries we got from companies engaged in that, companies like Hyundai, companies like Uber, that already have operations and are interested in exploring partnerships with companies in New Hampshire is a good example of how technology will play a stronger role in the transportation needs of the region.”

There are a few barriers that could stand in the way of progress. One is national trade policy.

The report mentions the U.S. has been involved as either a complainant or a respondent in 280 trade disputes addressed by the World Trade Organization, compared to 54 in 2019. Foreign direct investment in the U.S. has declined consecutively for four years in a row, starting in 2016.

Last year also marked the initiation of requirements of the Foreign Investment Risk Review Modernization Act of 2018. Sparked by concerns over Chinese-government involvement in FDI abroad, FIRRMA calls for scrutinizing FDI project proposals dealing with U.S. businesses in the fields of critical technology, infrastructure and data, which will deter FDI due to the longer processing timeline and regulatory costs. (Foreign direct investment from the U.K., Australia and Canada is excluded.)

That is out of New Hampshire’s control, but Dr. Wright thinks New Hampshire can move forward with an intentional plan involving key stakeholders, including universities and the Department of Business and Economic Affairs.

“Our research needs to be intentionally part of a cohesive plan, more so than any companies thinking on their own and making decisions on their own. All of these economic and business decisions are related,” said Dr. Wright.

Foreign companies may be scoping out New Hampshire towns and cities without officials aware of it. Cynthia Harrington, business development manager at the NH Division of Economic Development, advised towns have a clean website with clear links to available property, regulations and an overall polished presentation of the town’s assets.

Spontaneously, during the virtual presentation, labor shortage and lack of affordable housing took the stage as a significant domestic concern to business growth.

As Foxx Life Sciences adds three more clean rooms to assemble pharmaceutical products at its Salem facility, Taylor is nervous about how his company is going to meet four times its capacity, when hiring individuals with relevant manufacturing experience is already difficult.

“I just lost an eight-year employee to BAE. They (Boston companies and giants like BAE) can always trump you with the salary — they have the ability,” said Taylor, whose company offers $15-$16 an hour wages and has seen fewer job applicants during the pandemic.

“We still, to this day, do not have low-income housing and we don’t have enough people. And it’s going to get tough over the next couple of years,” said Taylor, who suggested, instead of 55 and older communities, there should be communities for people 35 and under.

“I think housing is going to be a huge issue,” said Ward, whose company has hired some unemployed persons since the pandemic, but generally had seen a lack of qualified applicants for manufacturing positions. “It’s really difficult to afford to live here right now. We need to figure out how to change that. It’s a big deal.”

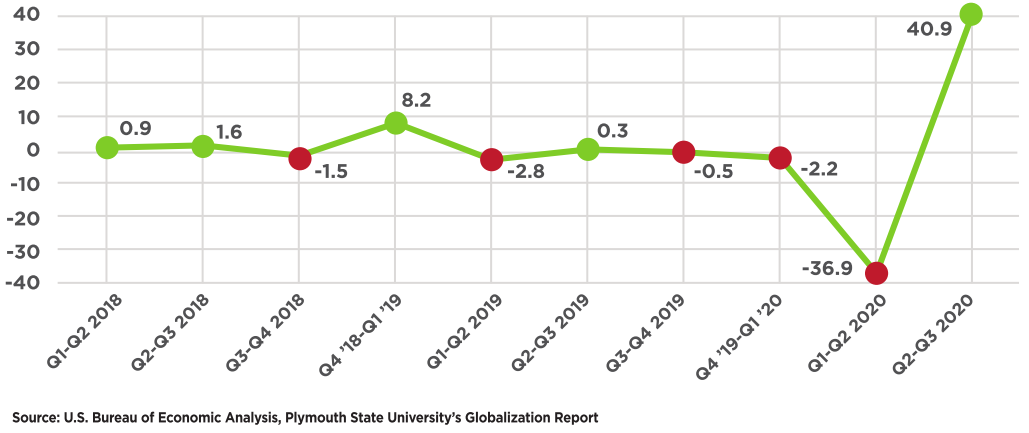

New Hampshire Real GDP Quarterly Percentage Change, 2018-2020

The state’s economy responded to the Covid-19 pandemic with a 2.2% contraction in Q1 and then a sharp contraction of 36.9% in Q2, due to the stay-at-home order that took effect on March 27 and expired on June 15. As economic activities resumed, New Hampshire’s economy grew by 40.9% in Q3, a pace that was ranked No. 8 among all states.

New Hampshire Monthly Exports and Imports of Goods, 2019-2020 (million USD)

The stay-at-home order triggered a downward shift of the state’s imports of goods from around $700 million per month between November 2019 and March 2020 to around $500 million per month since April 2020 and throughout the summer. Starting in the third quarter, demand for overseas resources and goods has been climbing to around $600 million per month, reaching $618.7 million in October. In contrast, the performance of New Hampshire exporters was relatively more stable and demonstrated stronger resilience during the pandemic. The state’s exports of goods increased every month from $440.7 million in January to $479.7 million in March during the time when Covid-19 first broke out in China and Europe. It dropped by 12.6% from March to May after the Covid outbreak in the U.S., but has since then been steadily recovering, reaching $487.1 million in October.