Covid and the budget are on the front burner for 2021

The

New Hampshire House held its first session on Jan. 6 as lawmakers took

part from the socially distant confines of their car in a parking lot at

the University of New Hampshire. (AP Photo by Charles Krupa)

Less is more.

That was the recommendation, and prediction, made by Senate Majority Jeb Bradley for the upcoming legislative session.

“This year we are not going to do everything we do in a typical session, so we have to work on the biggest things — protecting public health and trying to make sure we do everything we can to get people back to work. Those have to be the priority,” said the Wolfeboro Republican.

He added a few others priorities: keeping taxes down, broadband expansion, addressing affordable housing and, perhaps, energy.

Last year, lawmakers from both sides had moved forward on hundreds of bills only to see them hastily consolidated into a handful of omnibus bills as the pandemic forced lawmakers to limit meetings. One bill, House Bill 1234, contained 40 separate pieces of legislation and was so unwieldy that Governor Sununu vetoed it primarily for that reason.

This year, however, it could be even worse. The bills that last year were crammed into the omnibus bills, as well as others that didn’t even make it that far, can now be dusted off and resubmitted. But those bills were moved forward by a Legislature controlled by Democrats. This time around it will be Republicans making most of the decisions.

That does not mean nothing will happen. Indeed, since the entire process will be dominated by one party — albeit with slim majorities — some bills might have a better chance, not only of passage but also of being signed into law by the governor, who vetoed a record-setting number of pieces of legislation when Democrats controlled the Legislature.

The federal stimulus package is another wild card. Last year, Sununu had more money

at his disposal than the lawmakers. The legislative power of the purse

diminished, particularly in a non-budget year. This year, there is

another such package — smaller than last year but perhaps larger after

Democrats take control in Washington. How much money comes down the

pike, and what strings are attached, could again alter dynamics.

That’s the unknown. Here are some of the major pieces of legislation that have so far emerged as the new session begins.

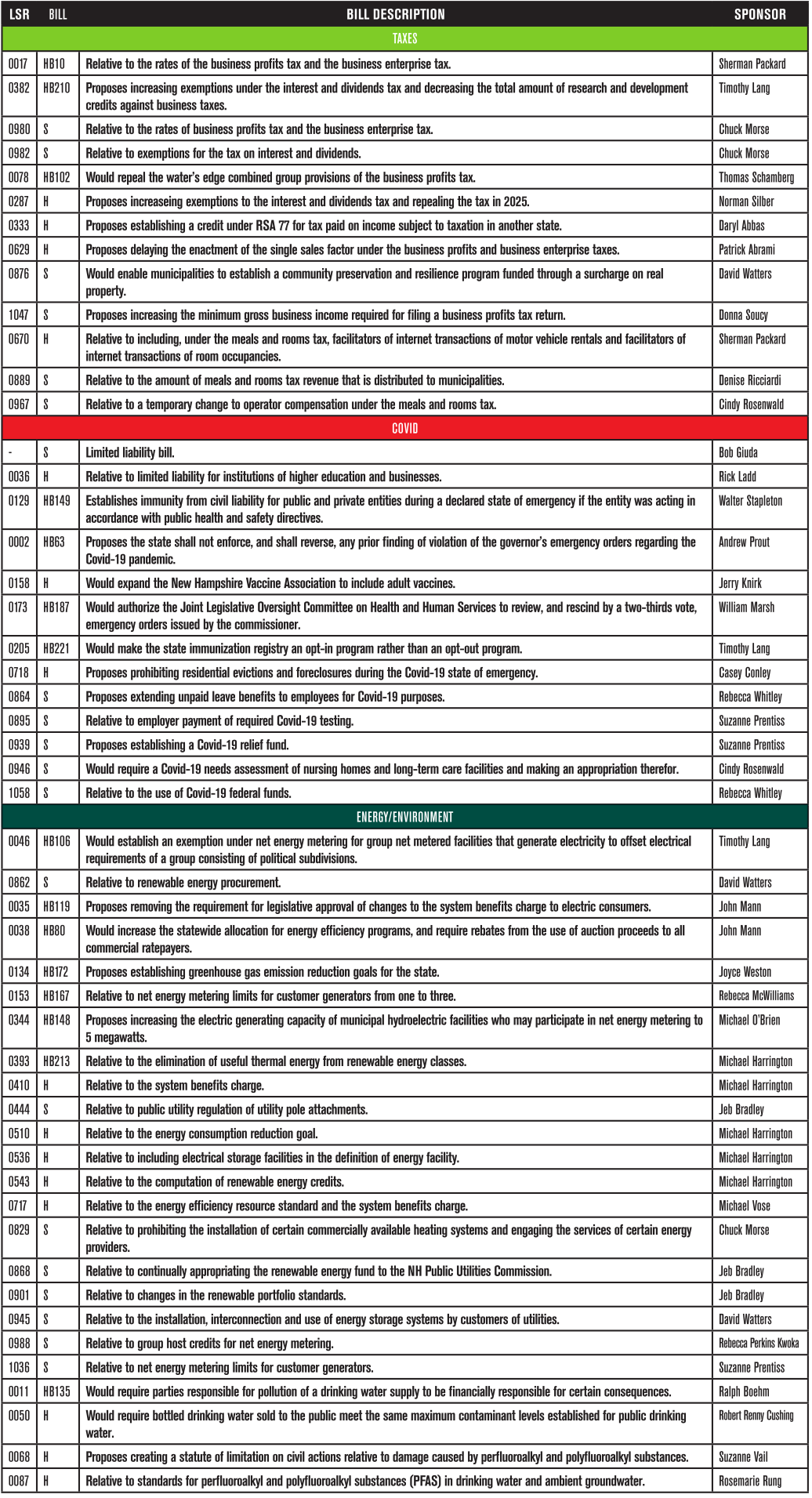

Taxes and the budget

The

state’s budget picture doesn’t look as bleak as it did last summer.

Indeed, revenues not only stopped their descent but climbed by the fall,

so the daunting deficit, once in the hundreds of millions, is now

estimated to be under $100 million.

There

is even more cause for optimism, since under Democratic control in

Washington, there might be direct aid going to the state and

municipalities. And with Republicans in control in Concord, that might

mean tax cuts.

Both

the House speaker and the Senate president are sponsoring measures to

cut business taxes. House Bill 10 would decrease the rate of the

business profits tax from the current 7.7% to 7.6% this year and 7.5% in

2022. It would also decrease the business enterprise tax from 0.6% to

0.55% this year and then 0.5% the next.

“Our goal is to lower taxes so we can attract more businesses into New Hampshire,” said Speaker Sherman Packard, R-Londonderry.

The

bill would also eliminate language that would have allowed tax

decreases to go forward only if revenues increased by more than 6%, and

would require taxes to go up if revenue falls by the same amount.

Neither happened, so the tax rate remained unchanged.

The

Department of Revenue Administration estimates that the proposed tax

cut would result in a $138 million decrease in revenue over the next

four fiscal years, based on an analysis using revenues from the 2020

fiscal year.

According

to the analysis, just shy of $6 million of that total would be felt

this budget year, which ends June 30. There would be a $78.5 million hit

to the 2020-21 biannual budget and a $53.7 million drop in revenue for

2023.

Such revenue estimates give even the other sponsors of the bill pause.

“The

thing that we have to consider is that if the economy doesn’t change,

and especially if it gets worse, then we are in deep trouble,” said Rep.

Norm Major, R-Plaistow, chair of the House Ways and Means Committee. “I

would like to make it happen, but I will make my final determination

after we have a public hearing.”

Major’s

predecessor, Rep. Susan Almy, D-Lebanon, said that it would be a

mistake to pass a bill without any triggers. “I think this bill is

incredibly risky,” she said. “This is the largest tax aside from the

property tax.”

But business groups are concerned about parts of the budget that affect their members.

The

Associated General Contractors of NH, for instance, is concerned about

whether there will be money for school construction, which was halted

for nearly a decade, first by a state aid moratorium and then slowed by

Covid.

It also wants

to make sure the Highway Fund, which has suffered from lower gas tax

revenues thanks to lighter traffic during the pandemic, is adequately

funded. While recently passed federal funding might fill that hole, it’s

not clear whether that will be entirely spent on road construction.

“It’s how that money gets spent,” said AGC Executive Director Gary Abbott.

Another

possible tax cut would come in the rate of the rooms and meals tax. No

legislation has emerged yet, but most people expect Sununu — who first

proposed it to help the ailing hospitality industry — will include it in

his budget package. It is expected to garner support among Republicans.

“It

would be good,” said Bradley. A tax cut wouldn’t affect whether people

go out to eat, but “it might make a difference on big things like

weddings and convention centers.”

The

reduction would slightly cut into the commission restaurants and hotels

get for collecting it, but it also enables them to raise prices without

customers noticing it and “that far outweighs the little bit of

commission to collect it,” said Henry Veilleux, who lobbies for the NH

Lodging and Restaurant Association. Even better, he said, is a bill that

would increase that commission, though the size and the duration of the

increase has yet to be disclosed.

Finally, there is an effort to reduce the interest and dividends tax.

Rep.

Norman Silber, R-Gilford, is proposing to eliminate it altogether.

Another bill — HB 210, proposed by Rep. Timothy Lang, R-Sanbornton —

would increase the exemption on the I&D tax from $2,400 to $3,500,

and decrease the total amount of research and development credits to be

used against business taxes from $7 million to $2 million. That bill is

strongly opposed by the BIA.

Covid and health

There

are at least 30 bills directly dealing with Covid-19, addressing

everything from vaccinations to nursing home regulations, as well as

bills restricting the state of emergency and increasing legislative

control over federal Covid funds. But the biggest priority for business

organizations is a bill being developed by Sen. Bob Giuda, R-Warren, and

supported by some 35 business groups, that would back Covid-related

liability.

The bill

would provide a safe harbor, meaning that a business couldn’t be sued as

long as it is following guidelines, he said, although “bad actors”

would not be protected.

“But

the last thing businesses need now is a frivolous lawsuit that will

cost someone $40,000 or $50,000 just to defend against it,” Giuda said.

Businesses

locally and nationally have long been pushing for liability protection

against lawsuits. Giuda said he knew of no such suits in New Hampshire,

but he added, “it only takes one. Someone is going to sue.”

Sununu

has said he supports liability protections but would prefer it at a

national level. Business lobbyists in Washington pushed for such

protections in the stimulus bill, but Democrats, who will soon have

power in Washington, successfully blocked it.

So

the BIA delivered a letter to Governor Sununu and the leaders of both

parties in the Senate and House urging them to follow in the footsteps

of 16 other states that have adopted similar legislation.

The

legislation is among the BIA’s top priorities, said David Greer, vice

president of policy, who emphasized that such a measure wouldn’t just

protect businesses but also hospitals, municipalities, and public and

private schools.

There

are bills that would allow emergency procedures put into place during

the pandemic to become law. One, backed by New Hampshire Lodging and

Restaurant Association, would continue allowing beer and wine

deliveries.

Another

bill, strongly backed by the NH Grocers Association, would expand keno —

now restricted to restaurants — to convenience stores. It would be good

for the stores, since keno operators are paid an 8% commission,

compared to the lottery tickets’ 5%.

“If they can’t get it in a bar, this would be a convenient alternative,” said John Dumais, who heads the grocers’ trade group.

Real estate and construction

Affordable

housing was one of the few policy initiatives mentioned in Sununu’s

inaugural address, and both parties say they want to do something about

the state’s affordable housing shortage.

One

bill, sponsored by Rep. Joe Alexander, R-Goffstown, with some

Democratic support, would offer incentives to developers that build

workforce housing and help clear municipal barriers that thwart its

development.

For Alexander, 26, housing is both a business and a generational issue.

“There

are businesses in the state that need to attract young talent. This is

the age spectrum where we need housing to be more affordable, so we can

increase the supply and make the state more marketable to us.”

The

new bill would allow Tax Increment Financing (TIF) districts to be used

for nonprofit workforce housing development, allowing developers to

avoid paying property taxes due to improvements on the property.

It

would also allow for doubling the duration of the tax breaks in

Community Revitalization Districts — usually reserved for downtown

commercial development — if, for instance, a developer adds affordable

housing on the second floor of a building. And it would allow a

municipality to define how large a downtown is to be part of that TIF.

Under

the bill, municipalities that adopt this and other workforce

housing-friendly policies could qualify for “housing champion

certification,” which would give them access to various state resources,

including discretionary state infrastructure funds as well as free

training.

The bill

also would strengthen the existing workforce housing law. For instance,

if a municipality allows increased density or reduces lot size for

construction of elderly housing, it must do so for workforce housing

too. It would require that planning and zoning boards provide specific

written reasons when rejecting workforce housing.

Another

bill, HB 154, sponsored by Rep. Casey Conley, D-Dover, would empower

municipalities to expand redevelopment tax breaks, now used to encourage

downtown development in order to create jobs, to the town outskirts to

encourage affordable housing as well.

Conley

also has proposed a trio of bills aimed at helping tenants. One would

postpone evictions an extra month (should the federal moratorium on

evictions lapse) for those demonstrating that they are seeking housing

assistance.

The other

would require landlords to provide a 60-day notice for rent increases

that exceed 5% and a 90-day notice for rent hikes over 8%.

His

final bill would remove any municipal requirement for an inspection if

tenants are applying for emergency housing assistance, “since a lot of

landlords would balk at that,” Conley said.

Other

revised bills aimed at supporting tenants include one by Sen. Rebecca

Perkins Kwoka, D-Portsmouth, that would require a 30-day notice (as

opposed to seven-day under current law) to evict for nonpayment of rent

if tenants have experienced Covid-related job loss. Another would allow

localities to distribute housing aid without requiring an eviction

notice.

Energy

Numerous energy bills are on the horizon this session but few have bipartisan support.

One,

HB 106, would increase fivefold the maximum size of a renewable net

metering project — not for businesses, just for municipalities.

The

bill, sponsored by Lang, has the support of Bradley and other

Republican senators, and the hope is to bring it to Sununu, who has

vetoed such bills in the past.

Speaking of renewables, there is an attempt to renew several bills that didn’t make it through last year.

Sen.

David Watters, D-Dover, is proposing a bill that would require the

state to procure renewable energy, similar to laws in other New England

states like Massachusetts and Connecticut. This would commit the state

to buy 800 megawatts, if economically feasible, with 600 megawatts for

offshore wind. While the law permits the energy purchased come from

other states, indeed even in conjunction with other states, the hope is

some might be right off the Seacoast, perhaps even developing a local

industry in building and installing the wind farms.

“This industry has incredibly high-paying jobs,” Watters said.

Bob Sanders can be reached at bsanders@nhbr.com.